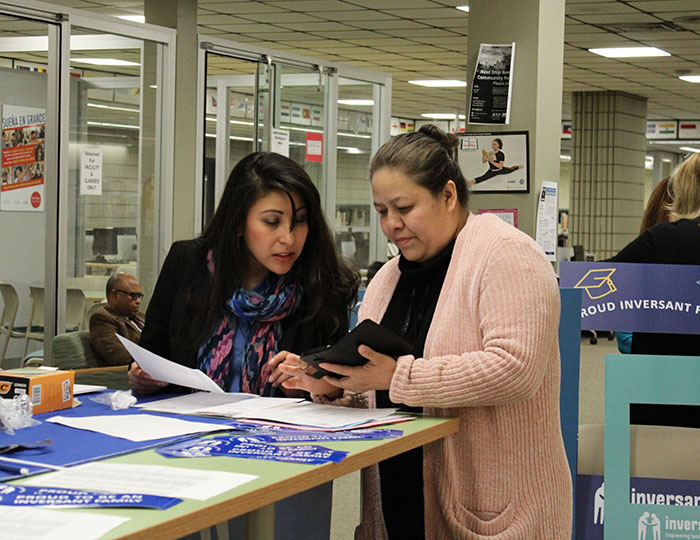

Accelerate Access for Inversant Families

In this time of uncertainty and increased need, we continue to build the capacity of the low-to-moderate income families we serve to achieve their goals for higher education.

MAKING COLLEGE ATTAINABLE FOR ALL

Inversant is the largest family-centered children’s savings account (CSA) initiative in Massachusetts. We empower low-to-moderate income families through a three-pronged approach:

- Motivating families to establish matched college savings accounts

- Providing college workshops and counseling

- Helping families identify and apply for scholarships to minimize college debt

Over the past decade, Inversant has reached 1,800 families who have saved more than $1.6 million (matched to equal $2.8 million) by opening 2,000 savings accounts and intentionally building a habit of savings. Inversant is proud to have helped send more than 700 low-to-moderate income students to college.

ACTIVE ENROLLED Families

Across Boston, Chelsea, Lynn, Revere, and Salem—communities with higher-than-average rates of poverty.

COLLEGE-BOUND Students

Within the active enrolled families we serve throughout the greater Boston area. These are the kids who benefit from our programs.

%

LESS THAN $30K Income

Almost half of the families we serve have reported an income of less than $30,000 per year.

%

INCOME BETWEEN $30K-$50K

Almost a third of our families report an annual income of $30,000 – $50,000.

%

PARENTS WITH DEGREES

Less than a third of the parents enrolled in our programs have completed a degree.

%

PARENTS WITH SOME COLLEGE

About a fifth of parents have completed some college courses.

%

LATINO FAMILIES

More than half of families enrolled identify themselves as Latino or Spanish speaking.

%

BLACK FAMILIES

A quarter of Inversant families indicated that they’re Black or African American.

%

COMMITTED TO EDUCATION

All of our active enrolled families are completely committed to educating their children.

ADVANCING COMMUNITY CAPACITY

Ultimately, Inversant aims to build the capacity of low-to-moderate income families to achieve their goals for higher education, decreasing the achievement gap between low-to-moderate income students and their more affluent peers. Our model of direct, whole-family engagement is unique in the CSA program field, and we have proven it to be effective. In our short history, Inversant has achieved tremendously positive outcomes for students and families, demonstrating the power of this saving/learning model and supporting our efforts to expand the program further to maximize impact.

- We have taught more than 500 workshops to at least 20,000 attendees.

- Our 1,800 families have saved more than $1.6 million (matched by Inversant to equal $2.8 million) by opening 2,000 savings accounts and intentionally building a habit of savings.

- An impressive 94% of Inversant’s high-school graduates have gone to college. Close to 90% remain enrolled in college after one year, a persistence rate much higher than the national average (68.7%).

- At least 74% of Inversant students attending four-year colleges graduate within six years, higher than the national 6-year graduation rate (59%).

THINKING BEYOND THE PANDEMIC

Inversant recently completed a rigorous strategic planning process, conducting interviews with staff and stakeholders and reviewing documents, data, and processes to identify our strengths and weaknesses. We are ready to take a significant step forward, implementing an ambitious program that will scale up our programming and thus our impact, allowing us to address the growing demand for our services.

Inversant is uniquely qualified to meet this challenge because our service delivery model combines established savings accounts; an engaged population at increased risk; the field and technical expertise to design and deploy remote education and emergency aid.

We have developed the following five-part plan, made especially urgent by the current public health crisis, to reduce barriers to access and increase our impact:

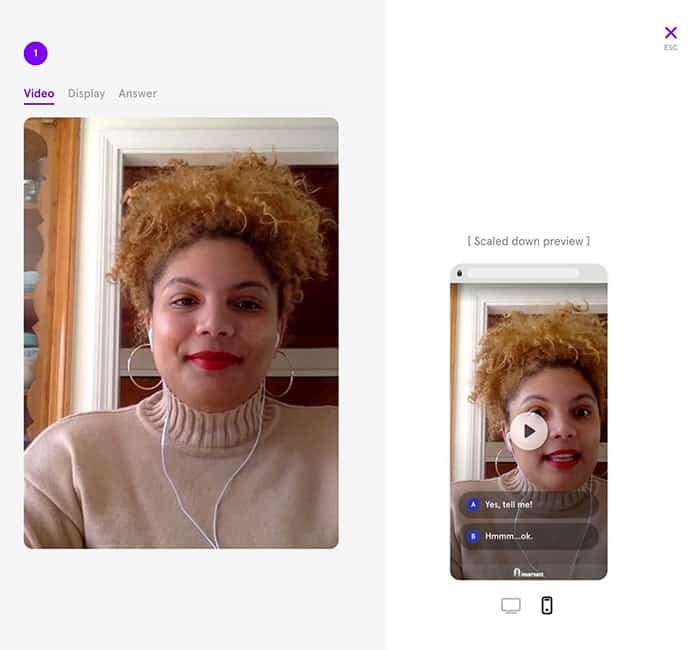

Interactive Web-Based Learning

The recent public health crisis resulting from the spread of the Coronavirus has resulted in the suspension of all of Inversant’s in-person group workshops. As a result, we have accelerated development and implementation of a web-based learning system, so that we can minimize the impact to our program delivery schedule. While this project and its related expenses were originally intended for 2021, we must implement them immediately so that we can continue helping families meet college application and financial aid deadlines, which remain unchanged.

Knowing that our constituency suffers from lower than average digital literacy and access, we will incorporate incentive-based engagement tools, and video counseling into the new system to boost participation. Having an interactive online learning option will add value long after the current public health crisis ends, as it will provide yet another way for Inversant families to access our services.

More Savings Accounts

Improve access to Inversant’s financial services and accounts by partnering with Metro Credit Union, the largest state-chartered credit union in Massachusetts, offering a range of low- to no-cost financial products to its customers. In the coming year, Metro will help 100 new Inversant families open CSAs and will provide them with free financial counseling services and college investment coaching. Metro will also supply technical support to help Inversant scale and streamline our savings and incentive programs to allow us to serve more families.

Partner Hosts Open Enrollment Workshops

Improve access to Inversant’s innovative workshops by partnering with community-based organizations to serve as pilot hosts. Project Hope Boston, a Dorchester-based agency that helps move women and families out of poverty, will offer Inversant’s workshop series over four months. Margarita Muñiz Academy, Boston Public School’s only dual-language (English/Spanish) high school, will offer Inversant’s workshops to its students and their parents. UMass Boston will offer Inversant’s workshops to college students in a single-day seminar. Urban College will host Open Enrollment days for students and community members to register for Inversant’s workshops, which they will deliver over two weeks. Due to the COVID-19 crisis, many scheduled workshops have had to be delayed. Once we complete our web-based learning system, we will work with host partners to adapt postponed workshops, adding financial incentives for enrolled families to help increase participation with our new learning delivery methods.

Expand Scholarship Programs

Expand our new scholarship program to serve more families. In addition to our existing Inversant Scholarships, Inversant will pilot the Last Dollar Scholarship program, which seeks to fill the gap between the combination of financial aid and student savings, and actual college bills. We anticipate these gaps will be larger than ever due to the COVID-19 crisis, so we will expand the award base to meet this increased need. We will award ten Last Dollar Scholarships, with award amounts determined by need. All applicants to both scholarships will benefit from counseling and workshops to increase their financial literacy and college readiness.

Alumni Emergency Fund

Deploy an Alumni Emergency Fund. Families with verifiable need, who hold Inversant savings accounts and have a student enrolled in college or servicing student loans, can apply for as much as $500 in education-related expense relief. We are building the capacity to deploy these funds quickly, on a rolling basis. This fund will serve as the foundation for future alumni-based financial assistance programs.

This project—both the urgently needed web-based learning system and the project overall—will expand Inversant’s ability to meet programmatic goals across a far broader population: building the capacity of low- to moderate-income families to achieve their goals for higher education, increasing the number of families who open CSAs, creating a habit of savings, and augmenting school and community-based college advisory efforts through Learning Circle workshops. This pilot will allow us to expand our impact to meet the growing need in our community, our state, and eventually, our nation.

ADDRESSING IMMEDIATE CHALLENGES

BUILDING AN EMERGENCY FUND

Inversant families are experiencing a range of financial and emotional burdens: loss of jobs and income, uncertain college living situation, insufficient access to computers, Internet connectivity, and stress over the lack of access to relevant information. We anticipate receiving as many as 730 applications for emergency funds.

MEETING INCREASED NEED

EXPANDING SCHOLARSHIPS

The Emergency Fund will evolve into our scholarship program. Families with an Inversant Savings Account, a student currently enrolled in college or are servicing a student loan, and demonstrated need can apply for up to $500 per student.

IMPROVING RESILIENCY

DIGITAL PROGRAM DELIVERY

Accelerating our transformation from a single-channel delivery of programming to multi-channel is necessary for achieving a greater scale at Inversant and ensuring continuity in and access to programming.

INVERSANT FAMILIES NEED YOU

HELP ACCELERATE ACCESS

We are asking our inside family for consideration of two things to help Inversant and to help our families not fall through the cracks.

1. One is a gift today and

2. Make a three year pledge.

The three year pledge will give you time to adjust a payment plan that fits the times, and provide an asset that Inversant can put on its books. Inversant can then leverage the pledges as collateral for credit.

HEIDI HANCOCK | VP Advancement

Don’t hesitate to reach out to me directly if you have any questions or would like to discuss your pledge/donation further. My team and I will be happy to co-ordinate convenient alternate methods of payment for you.