Getting a college degree is more important than ever. Yet, only 60% of at-risk students enrolled in college finish within six years.

While undergraduate completion rates have risen over the last decade, at-risk student rates remain low.

That’s why we’re committed to bashing today’s top barriers to higher education. In our latest research, we expose the barriers faced by low-to-moderate income families.

On November 3rd, we bring that research to you during the 2nd Annual Barrier Bash. Throughout the evening, we’ll share each barrier, including personal appearances by Inversant Alumni.

We’re thrilled to welcome special guest and Keynote, Jackie Jenkins Scott, President, and Founder of JJS Advising. We’re also grateful to our long-time collaborator Metro Credit Union who’s helping to make this evening possible as the Barrier Bash Title sponsor.

Plus, special thanks to Eastern Bank, Wegmans, Enterprise Bank, and Wellington Management.

Grab a sneak-peek below into the five most common barriers to college success. Then join us on November 3rd!

Together, we’ll close the opportunity and achievement gaps.

What Are the Top Barriers to College in 2021?

In the recent Inversant study, we delved into the top struggles and barriers low-income college students experience getting to and through college. The results were shocking.

While costs and money are a huge part of the challenges students face, they aren’t the only ones. The odds are stacked against lower-income students from the very start.

Personally, knowing what challenges I faced beforehand, helped me find resources to better support myself on my college path.

Through Inversant’s research, you can do the same.

Today, we’re exposing the top 5 barriers to college. More than that, we share the solution to dismantling and upending each challenge for college students across the Commonwealth of Massachusetts.

1. Financial Barrier to College

The Barrier

The rising Cost of Attendance (COA) for college is a major problem for most students in America trying to get a degree. This is especially a reality for lower-income students.

Beyond the COA, the money to pay Beyond the COA, the money to pay for higher education and college-related expenses is limited when you’re only making enough money to cover your rent or make ends meet.

On top of paying your daily bills, household bills, and trying to save – trying to make space in your budget for college can feel impossible.

Taking out a Federal Student loan definitely is an option. But whether you finish your degree or not, those loans have to be paid back, often leaving you in a bigger hole than what you started with.

The Solution

Financial reasons are always at the forefront of people’s minds when making the decision to pursue a college degree.

When I made the decision to go back to school, I planned a whole year in advance. I work a full-time job, so I wanted to make sure that I would succeed and save for my big decision.

I also save for my retirement and my emergency savings. As a huge fan of personal finance first thing I did was take a look at my expenses.

I planned creative ways to save. I also found low-maintenance side hustles to help me bring in extra cash. Next, I filed my FAFSA. Then I took a look at my college award letters.

Thinking ahead, I also used a portion of my tax return and allocated it to my emergency savings account, so I could take that expense off my plate for a little.

Finally, I asked for help. Thankfully for me, I have an amazing friend and mentor who gifted me $1000 when I had a hiccup with my student loan.

While I feel very fortunate to have someone like that in my life, I know not everyone does. If you do, make sure to ask. You never know how people can help out whether it’s with money or resources.

Make sure to check out our blog on the Top 7 College Planning Tips Nontraditional Students Can’t Afford to Miss.

2. Academic Barrier to College

The Barrier

It’s no secret that the education system for many lower-income, BIPOC, or first-generation students are completely under-resourced.

As a matter of fact, the eighth annual High School Benchmarks report from the National Student Clearinghouse found that as of Nov. 16, “college enrollments dropped by 6.8 percent—more than quadrupling the pre-pandemic rate of decline, a pattern magnified based on the poverty level.”

With all the disparity and resource gaps in lower-income communities, it could be hard to finish high school, let alone plan for college.

In my case, I’m not sure how I got through high school.

During my first attempts at college, I was completely unprepared. The lack of readiness made me feel bad about myself and my intelligence.

The Solution

I quit going to college a couple of times before it actually stuck for me. Juggling finances, my job, and my family – paired with my lack of college readiness – made for the perfect storm.

I bailed. Then it finally dawned on me – I’m not dumb and I can do this.

First, I prepared ahead of time and identified my academic obstacles. Next, I chose a 2-year college that offered an assessment exam. This helped me see where my academic strengths and weaknesses are.

The college then followed up by sending my classes to help support me in my success. Living in the tech age is also helpful. Some variations of these college assessment tests are online.

Check out the assessments College Board offers. Plan to take them ahead of time to see where you land.

3. Skill Barrier to College

The Barrier

I don’t know about you, but I never saw my guidance counselor in high school. Filling out college applications, choosing colleges, working through my financial aid all on my own left me at a total loss.

Years after I left high school, when I decided to enroll back into school, I had no idea where to begin. This story is true for many lower-income students and families.

While many low-income and first-generation college students have active family members who support their college dreams, they may not know how to explain the exact college process.

A friend of mine growing up didn’t know how to navigate the process. After high school, she attempted to sign up for a local community college. Once she saw the bill, she was completely discouraged.

She had no idea how she would pay for it. At that time in her life, she had no idea that there was help available like FAFSA. Make sure you don’t make this same mistake!

The Solution

Again tech comes to save the day. There are so many resources available online in various languages to help students and their families feel confident in applying for college and financial aid.

Researching online can teach you how to pick the best college for you, apply to that college, and sign up for financial aid. For example, Inversant has self-paced, online courses to help students understand how financial aid works and how to fill out FAFSA.

These online courses or “learning circles” are in English and Spanish and can be done from the comfort of your home.

If you’re planning on going back to college or a parent of a child planning to go to college, this course is a MUST. Sign up today for our Inversant Learning Circles.

4. Social Barrier to College

The Barrier

The college experience for wealthier students is a whole different experience than what many lower-income students face. Some students have the opportunity to live on campus, play frisbee on the quad, and focus on their studies.

Often lower-income students have a lot more on their plate, and many students work full-time jobs and some even have families to provide for. While financial aid packets have become more expansive, sometimes it’s not all about money.

Being a student who can’t afford anything on campus feels like crap. And, as an adult learner in day classes with a lot more younger students, you can also feel your confidence slip.

Not seeing people like you on campus can make you feel like you’re in the wrong place too. All of that to say, it’s hard to stay motivated when there’s a social disconnect and you feel like you don’t belong.

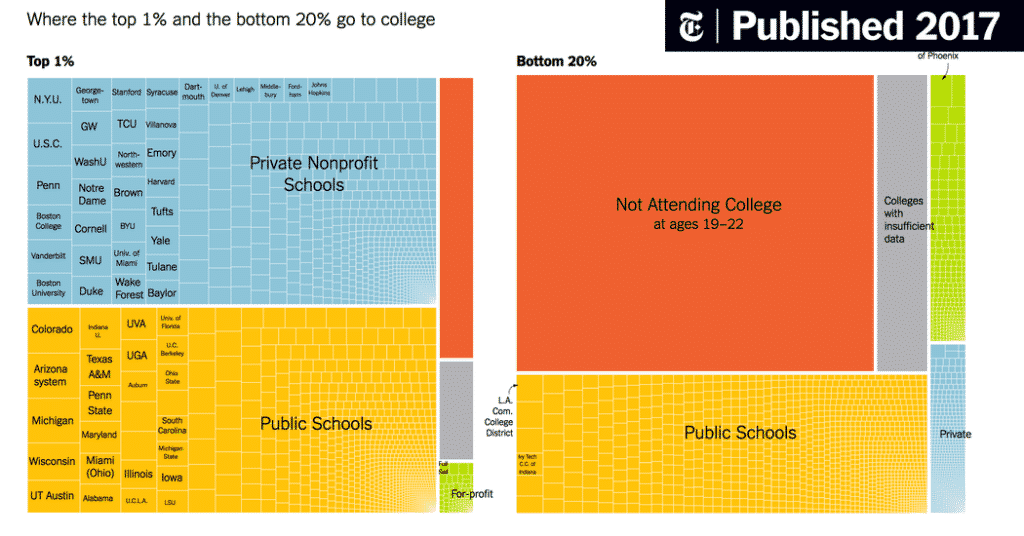

In a report by the New York Times, it’s stated that “38 colleges had more students from the top 1 percent than the bottom 60 percent.” One of my closest friends is first-generation and was raised in Los Angeles.

She received a scholarship to attend an Ivy League college in New England. While it’s a true testament to her hard work in high school, it wasn’t without serious implications.

The cultural difference of coming from a BIPOC school and community to a historically wealthy college made her feel like she didn’t belong there. She knew getting her degree there, would afford her opportunities to get a good-paying job and help her family.

While she was able to finish her degree, some of her friends who were on similar tracks weren’t so lucky. This is a barrier many lower-income and first-gen students face.

The Solution

Setting yourself up for success is intentional. It’s a more thoughtful process than a good financial aid package at a designer school.

It’s important to feel comfortable where you decide to go to college. You’re making an investment in yourself. If having a social connection in this process is of value for you, research your options in-depth.

Know what you’re getting into. If representation is important to you, make sure you find a school that provides that. If smaller campuses are what you feel more comfortable with, look for schools that can provide that.

Another great alternative is online college courses. Tech has brought us the ability to receive a degree online.

Many Millennials and Zoomers are much more comfortable connecting with people in a larger community online. Go with what feels right for you.

Want to listen in as we chat about each of the 5 barriers? We tackled this topic on Inversant Insights!

5. Culture Barrier to College

The Barrier

While many low-income and first-gen families support and wish for their loved ones to get their college degrees, oftentimes, the need for money is more important.

Juggling school and a full-time job is no easy task, especially when you have a family to provide for or to contribute to. For some students, parents don’t know how to support them through the college application process. They’ve never had to fill out.

First-generation dependent students may have parents or guardians that are undocumented. This makes FAFSA tricky to fill out. For others, it’s too exhausting to do so much in a day along with life.

A friend of mine is a native Spanish speaker and emigrated here from the Dominican Republic 3 years ago. In those 3 years, I have seen her have 2 babies, receive her citizenship, advocate and succeed in her bringing her young daughter here.

She signed up for ESL, got a job, found housing, and is now learning to drive. In 3 years she has accomplished so much. She eventually wants to go to college to study something that will pay her more money.

Everything listed is things she needs to secure, so she is safe and stable. Only after creating that stability can she start to plan for college.

Many people take for granted that they’ll never have to experience any of the above.

The Solution

My friend has a long-term plan and is in this for the long haul. Everything she’s acquired is a stepping stone to help support her dream. A dream job, dream house, and her version of the American dream for her family.

For me, cultural barriers are a big one to navigate around. I even had a great role model to watch who did it before me. My father is from Puerto Rico. He has worked hard for my family.

He managed to secure a job that he worked at for years so he can receive a free college education. He’s now currently working on his Ph.D. My 61-year-old and amazes me daily.

My point is, as someone who knows first hand, and has taken breaks from school; take your time. This isn’t easy to accomplish, especially dodging these barriers. While some lower-income and/or first-generation students complete their bachelor’s in 4 years with no student debt, there are many that don’t.

That’s okay. We’re human with so much on our plates, it can feel overwhelming. People who don’t go through these barriers have a different timeline. When you get discouraged, pick yourself up.

Just know that there are many people in America who are going through the same struggle. In my mind, it’s like a built-in community, a support system that knows the struggle.

They’re the team I want to win, despite these unfair barriers. Moments when I feel doubt, I refocus and center myself. I take a look at my potential struggles and I start to work through the barriers.

I think of solutions to potential hiccups that may occur. I stay on top of my budgeting and savings plan. I research more scholarships.

Staying proactive about your challenges is like savings and expenses. Take things day by day to succeed.

Bashing Barriers to College

The 2nd Annual Inversant Barrier Bash, a night committed to tackling today’s top barriers on the road to higher education, is right around the corner.

Featuring fabulous speakers, an insightful (and entertaining) look at college life, and a side-splitting round of “never have I ever.” You won’t want to miss it!

Join us on November 3rd at 6 pm ET to help us raise $30,000 to bash college barriers!