Are you a student dreaming of earning your college degree? Are you a parent hoping your student can find an alternative to hefty student loans?

You’ve come to the right place!

While paying for college can be the biggest hurdle to higher education, it doesn’t have to break the bank.

Even with the student loan debt crisis, there are ways to pay for college without a debt burden. With free money like scholarships and grants available, the key is knowing where to find them.

That’s why we’re exposing your best options. In this article, you’ll learn how to:

- Find money to cover college costs

- Discover the best financial aid options

- Pay for college with scholarships, grants, and more!

Plus, grab the Infographic below and share or pin!

Grants and Scholarships: What’s the Difference?

Knowing how the financial aid process works will open up a world of opportunity. It will help you understand what’s available and the most generous package.

As you begin, it’s essential to know the differences between financial aid award letters. While they can look different, almost all convey the same basic information:

- The amount of aid offered

- The type of aid offered

- How much funding you’ll need to enroll

Financial aid award letters tell you when the college is offering you free money by calling them a grant or a scholarship.

- GRANTS: get awarded based on financial need. They’re for at-risk students or those with disadvantaged backgrounds.

- SCHOLARSHIPS: get awarded based on merit with a focus on academic achievements.

How to Read Your Financial Aid Award Letter (Sample)

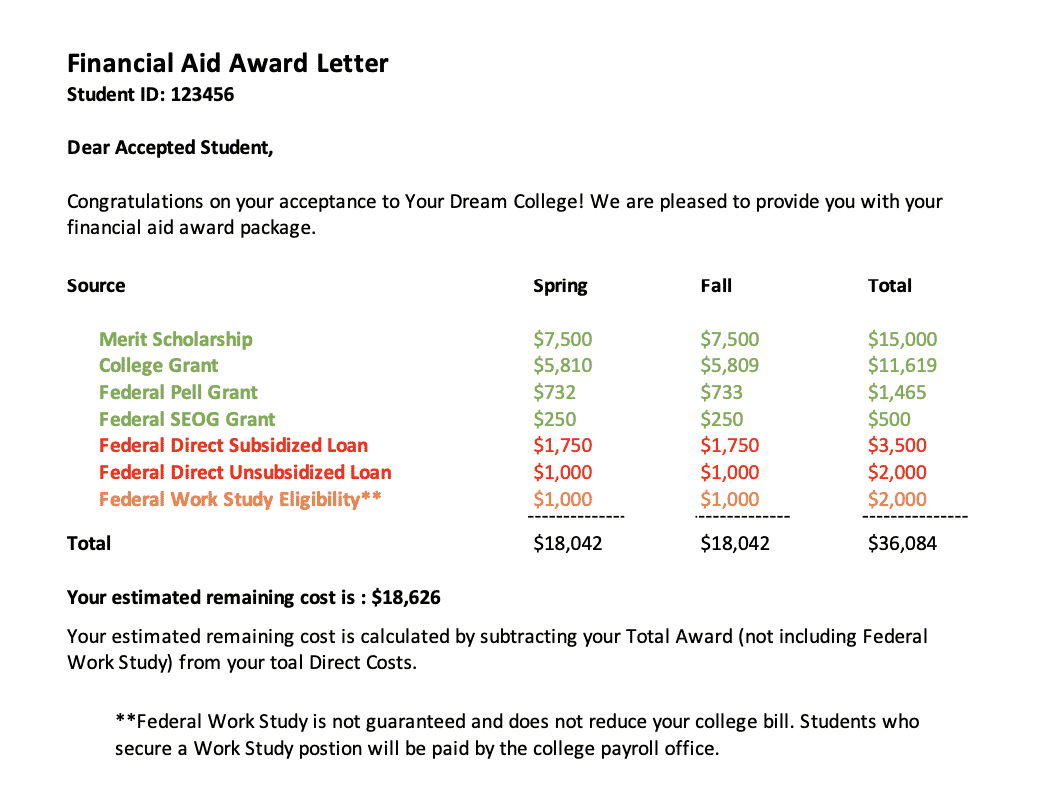

The following Financial Aid Award letter was sent to a student and is an excellent example because it clearly shows:

- Free Money (green): Grants or scholarships don’t require repayment.

- Earned Aid (orange): Eligibility for work-study is an offer for an on-campus job. Like any other job, it does not reduce the price you will pay overall or the bill’s amount when it comes due. You do not have to accept a federal work-study job and may find a higher-paying part-time job not part of the work-study program.

- Loans (red): Federal Direct Loans that require repayment with interest.

In this example, even after receiving total financial aid of $36,084, this student is still at least $18,626 short of the total amount necessary to pay the first-year bill – and that’s assuming the student accepts the offer of $5,500 in student loans.

To close this gap, the student could:

- Appeal to the college for more financial aid, or

- Search for third-party scholarships (a.k.a. private scholarships)

Knowing a little more about the financial aid process will help you determine if one or both of these options works best for you.

Sources of Free Money

There are two primary sources of free money, grants, and scholarships:

- The federal government, states, and colleges

- Other “third-parties” including:

- Employers

- Private scholarship provider

1. Need-Based Financial Aid

The largest provider of need-based student aid is the federal government. The Office of Federal Student Aid provides more than $120 billion per year of grants, work-study, and loans per year.

Need-based aid gets calculated based on parent and student income and assets. High school seniors who file the Free Application for Federal Student Aid, a.k.a. the FAFSA, are automatically eligible for federal need-based financial aid.

The U.S. Department of Education uses information on the FAFSA, including financial and other family information, to determine the Expected Family Contribution (EFC).

Colleges determine eligibility for need-based aid by taking your Expected Family Contribution and subtracting it from the cost of attendance for that college. In turn, the colleges use the EFC and other FAFSA information when considering how much financial aid to offer.

To estimate your EFC, use this free Financial Aid/EFC estimator. For more information about the FAFSA, visit Federal Student Aid.

Some colleges also require students to file a second “institutional” form to help the schools determine need-based aid eligibility. These colleges use the College Board CSS Profile® when making financial aid awards. For more information on the CSS, Profile visits the College Board CSS Profile.

One crucial point: to continue receiving need-based aid, students who move on to the next academic year (i.e., freshman, sophomores, and juniors) must file a new FAFSA before the college’s deadline.

Each year, the new form is available on October 1 and must be filed before the college’s deadline to be considered for aid in the next academic year.

DO NOT MISS THIS DEADLINE. You could lose ALL of your financial support.

2. Merit-Based Financial Aid

Colleges also award scholarships based on merit. Merit scholarships are often provided without a separate application for academic excellence, athletic prowess, artistic talent, and many other reasons, including geographic diversity, as a way for colleges to round out their freshman class.

Students are often not required to fill out a separate application to be considered for institutional merit aid. Some colleges award merit aid based on GPA, admissions test scores from the SAT or ACT, or other academic excellence measures.

The best news: neither need-based, merit-based grants or scholarships need to be repaid, and most come with no or very few strings attached. Students may also receive grants and scholarships at the federal, state, or institutional level and qualify for additional merit scholarships and prizes from third parties, as discussed below.

The student in the example above was awarded a combination of:

- Merit Scholarships: for some exceptional talent, academic performance, or something else that caused the college to offer the student “merit money.

- Need-Based Aid: Pell Grant, SSEOG Grant, Direct Student Loan Subsidized. Note that all students who file a FAFSA are eligible for Direct loans. Subsidized loans are offered to students with demonstrated financial needs. Unsubsidized loans are not need-based.

Appealing a Financial Aid Award Letter

The FAFSA form requires you to use tax records from two prior years. Students enrolling in college for the fall semester of 2021 will be attending the academic year 2021-22 (AY 21-22). The FAFSA form for that academic year requires parent and student tax returns for 2019. The determination of eligibility for financial aid for AY 21-22 is made on financial information that is two years old.

If your family’s financial situation changed substantially since then, a fact-based appeal outlining the Special Circumstances (i.e., job loss, illness to primary income-earning, death, or permanent disability, among others) could increase financial aid.

If your family’s economic circumstances did not fundamentally change, or even if they did, finding free money from a third-party, private scholarship provider might make the college of your dreams affordable.

Third-Party (Private) Scholarships

In addition to need and merit-based financial aid from the government and colleges, scholarships are awarded by hundreds of different organizations: employers, large national foundations, local charities, credit unions, banks, community clubs, and others offer free money to college-bound students.

Each year, industrious students as young as grade school compete for the billions of dollars of contests, prizes, and scholarships offered by private third parties.

One issue with these scholarships is that there is no standardization with the process. Each provider is likely to have different requirements and application processes. However, most scholarship applications include an essay, personal statement, resume, and something related to the scholarship’s nature.

While searching for free money from third parties, be creative and curious. There are prizes, contests, and scholarships for just about everything, from serious endeavors such as winning a national spelling bee or playing the piano to the fun and creative such as making prom attire out of duct tape or doodling.

There are scholarships for left-handed students, for people who’ve worked in an ice cream shop, and for students who have overcome specific hardships. Those are just three examples; if you can think of something you enjoy or take part in, there’s probably a scholarship out there related to it.

How to Find Contest, Prizes, and Scholarships Sponsored by Third Parties

- School Counselors. Check with the high school counseling office. School counselors are a particularly rich source of information for local and state scholarships. They know the sponsors, the criteria, and the student’s profile to quickly direct students to scholarships in the student’s area of particular strengths.

- Online scholarship search services. Many online scholarship search tools are offering to connect a student with billions of dollars of free money.

- This free scholarship search tool at MyCollegeCorner.com permits you to search using many filters, including “Success Rate.” The Success Rate filter allows you to see what percentage of applicants were previously successful when applying for an award. Some awards gave scholarships to everyone who applied (100% success rate).

- Some scholarship search tools (not MyCollegeCorner.com) require an email address to enter the site. You may want to read their Privacy Policy and Terms of Use to see if they will sell your email address to other marketing companies or colleges. Often, users who register will receive scholarship updates that can be helpful. On the other hand, some search tools bombard your in-box until you unsubscribe. One site continued to send a user periodic updates announcing that the student was eligible for a scholarship many years after she enrolled in college.

- Look in a book. In either digital or print editions, this old-fashioned approach still works well. The authors of The Ultimate Scholarship Book 2021: Billions of Dollars of Grants, Scholarships, and Prizes have written more than ten books on paying for college and scholarships. They pieced together more than $100,000 of scholarships to graduate from college debt-free.

- Check with Employers. Sometimes a parent’s employer might sponsor a scholarship for the children of employees – an excellent opportunity for free money and a source of pride for parents!

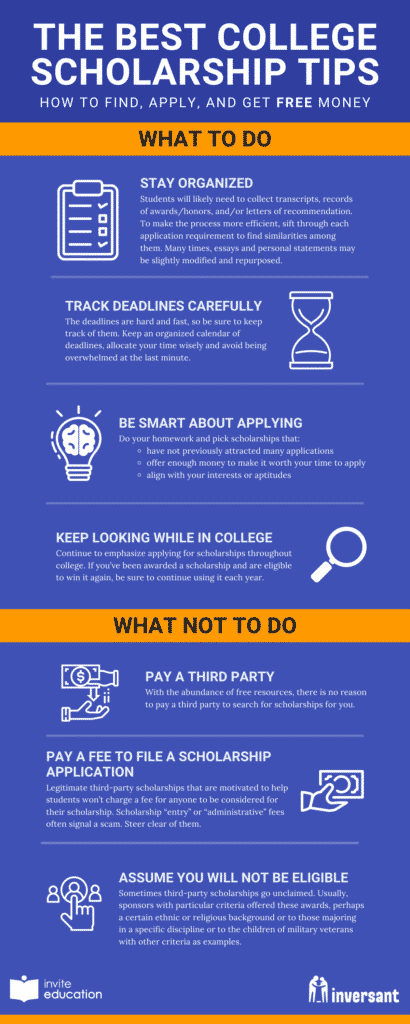

Tips for Applying to Scholarships

- Stay organized. Students will likely need to collect transcripts, records of awards/honors, and/or letters of recommendation. To make the process more efficient, you may sift through each application requirement to find similarities among them. Many times, essays and personal statements may be slightly modified and repurposed.

- Track deadlines carefully. The deadlines are hard and fast, so be sure to keep track of them. Keep an organized calendar of deadlines, allocate your time wisely and avoid being overwhelmed at the last minute.

- Be smart about applying. Since many scholarships choose from a long list of applicants, it’s wise to do your homework and pick those for which you will be particularly competitive. Consider the number of awards a provider will likely make, the number of applicants in prior years, and each scholarship’s dollar amount. Your obvious goal is to find scholarships that:

- have not previously attracted lots of applications

- offer enough money to make it worth your time to apply and

- align with your interests or aptitudes

- Keep looking while in college. There’s a big focus on scholarships for freshman year but a tendency to forget about them after that. Continue to emphasize applying for scholarships throughout college. If you’ve been awarded a scholarship and are eligible to win it again, be sure to continue using it each year.

Here’s What Not to Do:

- Pay a third party. With the abundance of free resources, there is no reason to pay a third party to search for scholarships for you.

- Pay a fee to file a scholarship application. Those who set up legitimate third-party scholarships are motivated to help students. They won’t charge a fee for anyone to be considered for their scholarship. Scholarship “entry” or “administrative” fees often signal a scam. Steer clear of them.

- Assume you will not be eligible. Sometimes third-party scholarships go unclaimed. Usually, sponsors with particular criteria offered these awards, perhaps a certain ethnic or religious background or to those majoring in a specific discipline or to the children of military veterans with other criteria as examples.

How Could Third-party Scholarships Affect Financial Aid?

Sometimes, financial aid can be reduced dollar for each dollar secured from a third-party scholarship, grant, or prize. Check with the financial assistance office to understand how a third-party scholarship will affect your financial aid eligibility.

And be sure to read the fine print to understand the terms of the awards and ask good questions:

- Is the prize for each year in college or just the freshman year?

- Do you need to reapply each year?

- Are there any other requirements to maintain the scholarship?

In calculating your financial aid package, outside scholarships could increase your EFC and decrease the need-based aid you may be eligible for. If the total amount of third-party scholarships is more significant than your estimated need, the need-based aid package could be reduced.

While it may seem like a good idea not to report any private scholarships to the college to avoid a reduction in aid, failure to report them could eventually result in paying back the over-award.

For many students, third-party scholarships are certainly worth pursuing – even if a college decides to offset some aid by the number of scholarships earned. As discussed earlier, there are three basic types of aid:

- Free money grants and scholarships

- Earned aid

- Loans

The most beneficial reduction in aid would be for the college to reduce the amount of loan aid. Replacing obligated loan dollars with scholarship dollars that do not have to be repaid would be the best outcome.

A Final Thought

Students have a variety of options to pay for college. Most families cannot save enough to pay for college without some additional aid.

The most desirable financial aid is free money: grants and scholarships.

The combination of need-based and merit aid is too often insufficient to permit students to pay the full bill.

In addition to working while in college or appealing for more financial aid, students can search for grants, scholarships, and prizes to fill the gap and reduce the need for additional student loans.

Share and Pin!