Saving money for college is hard, especially when money is tight. With the rising cost of college education, putting money aside might sound impossible.

But while tuition and livings expenses continue to rise, there are ways to start saving. Believe it or not, you can pay bills and afford college without going hungry.

Ready to learn how? Below are the 12 best ways to save for college, plus how to make wise savings decisions.

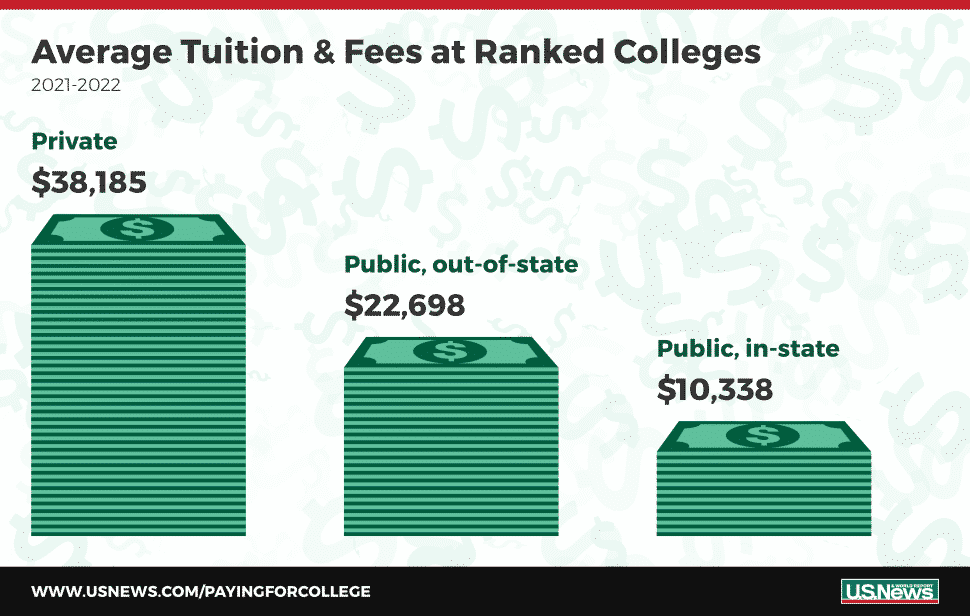

1. Determine How Much College Is Going to Cost

Planning is always a best practice when making any significant investment. If you bought a car, you’d plan around your budget.

Your education deserves the same due diligence in financial planning, and college is an investment for your future. Researching ahead of time will help paint a better picture of what your investment will cost.

Knowing how much your college of choice costs is a great way to put a price tag on your future investment.

While you may not have to pay that total price tag after filling out your FAFSA, knowing how much school costs will allow you to start setting goals.

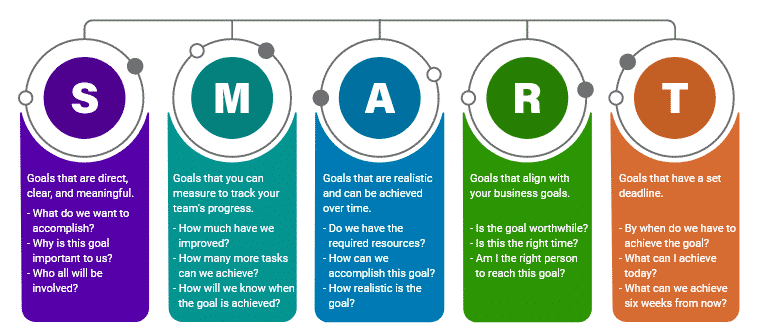

2. Set Your College Savings Goals and Plan of Action

As a Financial Coach, I can attest to watching the magic of clients smash their savings goals. This is how I function throughout my life, and setting financial goals and watching my progress is a great driver.

For example, on New Year’s Day of 2021, I decided to save $1300 by the end of the year. It’s essential to choose a realistic amount and an end goal date.

I would have loved to say, “I’ll save a million dollars by 2022,” but the way capitalism and my pockets work, that’s not realistic.

After doing some math, assessing how much money was coming in and out, and creating a budget, I came up with a Savings SMART Goal. That helped me feel solid in my goal, letting me put action steps in place to support its completion.

Once you accomplish your first savings goal and set your lifestyle up to support that goal, it’s an addictive feeling. The pride and satisfaction of staying committed to a savings goal will continue to propel you forward.

3. Open a 529 Account to Start Saving Right Now

A 529 savings plan is used to save for higher education. You want one because these accounts are not subject to income taxes, and when you use the funds to pay for qualified education expenses, the withdrawals are typically tax-free as well.

When you open a 529, connect it to your checking account. Then set it up so that the amount you aim to save passes automatically from your bank to your 529 each month.

In Massachusetts, Baby Steps is available to children born or adopted within the last year. Every eligible resident will receive a $50 seed deposit into their account.

If you don’t already have a 529 college savings plan set up, these payments could be an excellent way to kickstart those savings.

Plus, don’t forget to check out your child tax credit savings!

4. Adjust Your Spending Habits

Many people don’t spend unreasonable amounts, and adjusting habits when there’s low cash flow can be complex, especially when it comes to convenience.

Getting takeout after a long day of work may be the only thing keeping someone sane. And the advice, “If you stop buying a coffee a day, you’ll solve all your money problems,” doesn’t ring true for most people.

Meanwhile, the minimum wage is creeping up at a snail’s pace while the cost of living has skyrocketed.

Sure, it’s unfair, but the reality is, to save for college, you have to spend smartly. Remember, college is an investment in yourself.

It’s a gateway to access and the credentials you need to succeed. Until these systems of inequity are remedied, this is where we’re at. So how do you, as a college student, adjust your spending habits?

You can start with your mindset. I’m a person who enjoys many of the conveniences this modern world has to offer, and shopping is one of them. Wrangling my spending habits has always been a struggle until I decided to go to college.

The idea of a better future and making more money always felt right to me. So I made compromises with myself. Instead of buying coffee every morning, I treated myself on Fridays. The rest of the week, I’d make coffee at home.

Another compromise I made was not getting my nails done. I LOVE getting my nails done, but it can get very costly. I decided that I would do them at home from January until May.

Instead, the money I saved from that sacrifice I used to pay down my student loan. So you still get to treat yourself, but in a way that will also allow you to save more money for school.

Yes, it sucks and is unfair to live without certain luxuries that wealthier people couldn’t even fathom living without, but your college education is essential.

5. Make a Budget & Cash Flow Statement

I cannot stress enough how important it is to budget and make a cash flow statement when saving for college. Many people think that a budget is the same as a cash flow statement and interchangeably use the terms.

In reality, a cash flow statement shows how much money is coming in and out. Establishing your fixed and variable expenses budget is used after assessing your cash flow statement and deciding where you can trim some dollars to add to your savings.

Check out this video to see how to create an incredible cash flow statement so you can start to budget.

6. Consider an Online Savings Account

Saving early and often is always the best practice when planning for higher education. As an adult learner, it may be difficult to pinpoint where you can make cuts in your budget. That’s okay.

Whatever you can save can help you out of a tight jam while working and going to school. Many FDIC-approved online savings accounts offer high-yielding interest rates. Use those. That interest rate will help your money make money.

Another hot tip? Plan out your tax return ahead of time. Take a chunk of your tax return and dedicate it to investing in your education.

7. Set-Up Direct Deposit into Your Savings Account

Setting up direct deposits into your savings accounts is incredibly helpful. Life is hectic, especially when you’re a college student. Add working full time and a family to that equation.

Putting money away may not be at the top of your priority list. If you have direct deposit set up with your savings, you can essentially set and forget it.

8. Get Creative

There are always creative ways to save a buck and stash that in your savings account. One way I got creative is “no spend Wednesdays.” I don’t allow myself to spend any money on Wednesdays.

Another thing I do is save my coins, and when there’s a lot, I take them to a Coinstar, then deposit the money into my savings account. It doesn’t have to be big to make a difference. Every little bit counts!

Start Saving for College Today

As you can see, there are many ways to pay for college without going into student loan debt. Pick one idea or choose several.

Whichever way you choose to pay for your degree is all up to you. The only thing that matters is that your decision is sustainable.

Ready to take the next step and start saving for college today? We’ve got you covered!

Sign up for the FREE Inversant Savings Challenge. Learn how to double up on your savings and put your money to work for you!