Want to save more money for college? Not sure how to put enough away between now and graduation? You can do it.

And the best part?

It doesn’t require you to work additional jobs or longer hours. You can pump more money into your bank account and DOUBLE your savings.

All you have to do is take advantage of the Child Tax Credit, part of the American Rescue Plan, plus add in a few easy steps.

Ready to learn more? Read on!

American Rescue Plan Act (ARPA) 2021

In March of 2021, President Joe Biden signed into office the American Rescue Plan Act, also known as ARPA. This act is delivering relief to the American people, rescuing the American economy, and helping us beat the pandemic.

But how does the Child Tax Credit work? Below I share who it’s for, what you’ll receive, and how to put it to use for you or your child’s college savings.

Oh, and if you’d rather watch than reading (I get ya) – watch our Facebook Live where we discuss how to ramp up your savings.

Child Tax Credit in the American Rescue Plan

What’s the Child Tax Credit? It’s the largest Child Tax Credit relief in United States history for low to moderate-income families, increasing the amount parents receive per child.

The increase went from $2,000 to $3,000 for children between the ages of 6-17 and $2,000 to $3,600 for children under 6.

This is a big deal for many reasons.

- Before the bill was passed, a Columbia University study found that this plan would lift more than 5 million children out of poverty this year, cutting the poverty rate by 50%. WOW!

- For the first time, you can count on getting money on a monthly basis, instead of waiting for the beginning of the year.

So what’s the details and how much will you receive for the child tax credit?

- Parents started receiving payments in July and will continue until December.

- For every child you have under 6 you’ll receive $300 per month.

- For every child you have between the ages of 6-17, you’ll receive $250 per month.

- The monthly payments you get this year will add up to half of the full amount. You’ll get the remaining balance next year.

Now, here’s the best part:

- Everyone who qualifies will receive the tax credit.

- If you make up to $150,000 for a couple or $112,500 for a family with a single parent, you’ll receive the full amount.

- You don’t have to take any action to receive your tax credit. As long as you completed your 2019, 2020, or Economic Impact Payments, you should have started receiving your payments either electronically or by mail.

- If you didn’t file taxes or signed up for the Economic Impact Payments you can still get those payments. All you have to do is use the IRS non-filer sign up tool to receive it.

Take action now! You don’t want to miss out on getting those funds. Because once you have them, we want to put them to work!

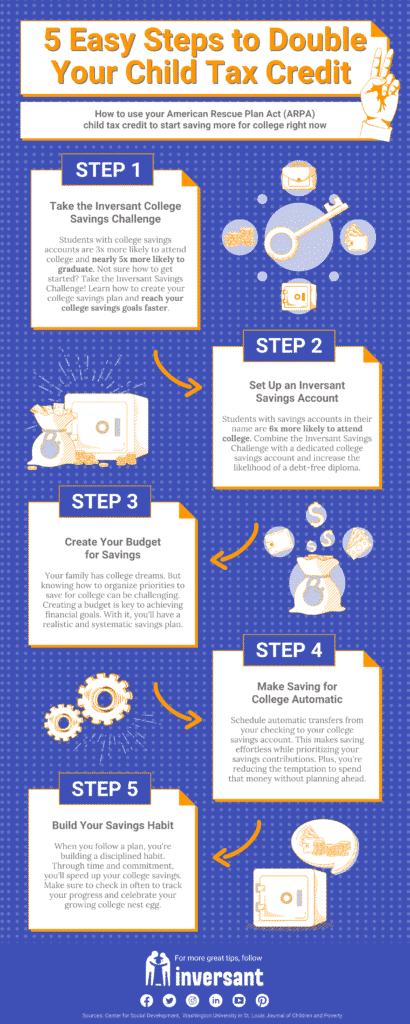

4 Steps to Double Your Child Tax Credit

1. Take the Inversant College Savings Challenge

Here at Inversant, we provide a variety of ways to help families and students get a higher education.

One of those ways is with our Savings Challenge.

Use your ARPA Act child tax credit with the Savings Challenge to:

- Create your college savings goals

- Maximize your college savings

- Build a habit of savings that pays for your degree

It’s that simple! Sign up now for pre-registration and get notified as soon as your VIP admission is ready.

2. Set Up an Inversant Savings Account

Another way to increase your savings knowledge and ramp up your savings is with an Inversant Savings Accounts.

Through our partnership with local bank, Metro Credit Union, we help you safely deposit your funds and begin your Savings Challenge.

We know that higher education is expensive. Building a savings habit, saving on a regular basis, and monitoring your progress will get you on the road to educational financial freedom.

After all, who doesn’t want to graduate debt-free? ????????

3. Create an Emergency Savings Account

COVID-19 may have exposed deep inequality within higher education, but it also helped us recognize the power of planning ahead.

Even if you feel you don’t have the luxury of putting money towards an emergency savings account, you can do it without it creating a burden.

While how much you save in your emergency savings account will vary, what you must consider is:

- Monthly living expenses

- Size of family (dependents)

- Income (consider the possibility of job loss)

- Your current lifestyle

Creating an emergency fund becomes a buffer when something like a pandemic happens. None of us saw it coming and many were left with unexpected expenses.

How should you save for emergency expenses?

Some options to consider when building your emergency fund are:

- High yield savings account

- Money market account

- Certificate of Deposit

- Traditional bank account

- Roth individual retirement account

The earlier you begin, the better off you’ll be. Not sure how to get started? Join the Savings Challenge and we’ll talk you through planning.

4. Invest in a 529 Plan

A 529 plan is not your normal savings account. It’s an investment account that offers tax benefits when you use the funds for school expenses.

A couple of things you should know:

- Review different plans offered by your state before choosing one for yourself.

- The money saved in this plan should be used for educational expenses.

- If the funds are not used for educational expenses, you will see consequences. You would have to pay a penalty and pay the taxes that you haven’t paid.

When you open a 529, connect it to your checking account. Then set it up so that the amount you aim to save passes automatically from your bank to your 529 each month.

In Massachusetts, Baby Steps is available to children born or adopted within the last year. Every resident who is eligible will receive a $50 seed deposit into their account.

Final Thoughts

The American Rescue Plan Act has helped many families with the increase of the child tax credit.

Best of all, you can use that to start saving and doubling your money for college.

Need more creative ways to save for college?

Join the Inversant Savings Challenge where we share tips, tools, and the knowledge you need to save more money for college right now.

Share and Pin!